how to file taxes for amazon flex

You will need to report your business income to the IRS and pay any amount that is due. To avoid the estimated tax penalty you must pay one of the above percentages through a combination of estimated tax payments and withholding.

The Amazon Flex Requirements That Every Driver Must Meet Ridester Com

Working as an Amazon Flex driver is no different.

. Turn to podcasts for company. With Amazon Flex Rewards you can earn cash back with the Amazon Flex Debit Card enjoy Preferred Scheduling and access thousands of discounts as well as tools to navigate things like insurance and taxes. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports.

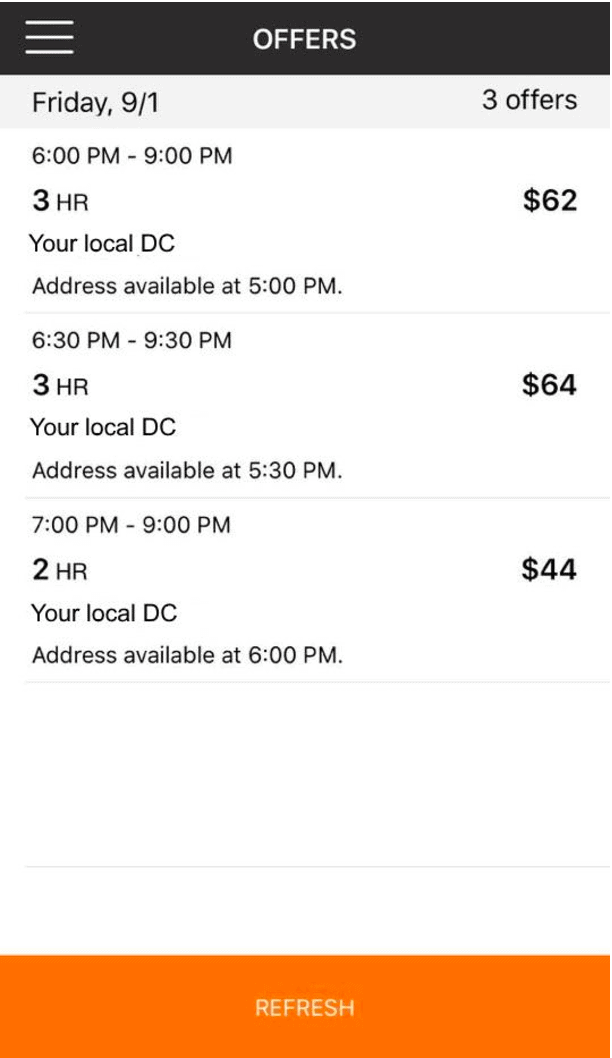

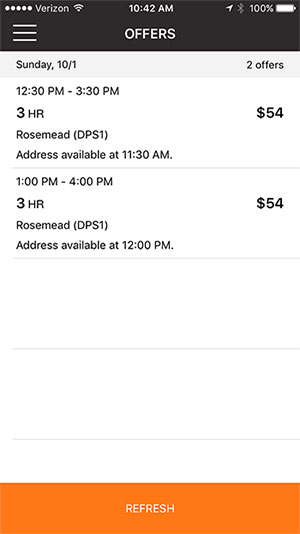

They can then use the app to select blocks of time consisting of days and hours when they want to deliver for the service. We all know the phrase you need to spend money to make money. Keep track of what you spend on Amazon Flex.

Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment. Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. 90 of the tax to be shown on.

You expect your withholding and credits to be less than the smaller of. The general rule of thumb is to put away 30-35 of your Adjusted Gross Income income reduced by tax write-offs for taxes. You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply.

Keep your app updated to the latest version. Stack Amazon Flex with other delivery apps. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits.

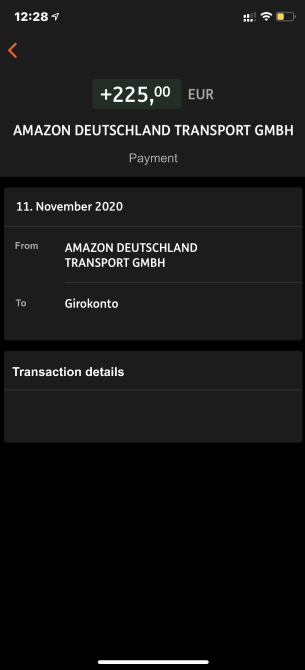

Youre suppose to pay quarterly which I will now dropping 27k nearly all at once will mess up my cash flow. As a self-employed independent contractor you will have to pay taxes and self-employment tax on your business income. You will also have to pay unemployment tax on any income you make at your job.

Drivers for Amazons courier service should download the app on their smartphone. Free software automatically fills forms. Amazon Flex will not withhold income tax or file my taxes for me.

Ad Confused about taxes. The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year. This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i.

Ad Browse discover thousands of brands. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. 100 of prior year taxes.

Its almost time to file your taxes. You pay 153 SE tax on 9235 of your Net Profit greater than 400. AGI over 150000 75000 if married filing separate 100 of current year taxes.

Read customer reviews find best sellers. I did flex full time in 2017 made about 30k and after deductions Ill owe around 27k. 90 of current year taxes.

110 of prior year taxes. How Much To Put Away For Quarterly Taxes. When the scheduled block begins drivers head to an Amazon delivery station or a nearby store or restaurant and then mark in the app that.

Once you calculate what that percentage is for the tax year divide that number by 4 -- and you have your quarterly estimated tax payments.

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To File Amazon Flex 1099 Taxes The Easy Way

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Amazon Flex 1099 Taxes The Easy Way

Is Amazon Flex Worth It 2022 Hourly Pay Requirements

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Amazon Flex Taxes Documents Checklists Essentials

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Do Taxes For Amazon Flex Youtube

Amazon Flex App Everything You Need To Know Full Tutorial Ridester

What It S Like To Be An Amazon Flex Delivery Driver Youtube

How Many Packages Does Amazon Flex Give You

How Much Do Amazon Flex Drivers Make In 2022 Hyrecar

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver